Newer Nicotine and Tobacco Products: Philip Morris International

This page was last edited on at

Since the early 2000s transnational tobacco companies (TTCs) have developed interests in newer nicotine and tobacco products, including e-cigarettes (also known as electronic delivery systems, or ENDS), heated tobacco products (HTPs), snus and nicotine pouches.

Companies have referred to these types of product as ‘next generation products’ (NGPs) although terminology changes over time.

As the harms from conventional products have become better understood, and tobacco control measures have been put in place, the cigarette market – from which tobacco companies make most of their profits – has started to shrink. To secure the industry’s longer-term future, TTCs have invested in, developed and marketed various newer products, including in low and middle-income countries.1 They are often publicly linked to tobacco companies’ harm reduction strategies and labelled ‘reduced risk’ or ‘modified risk’ products.

There is ongoing scientific and policy debate about the role of these products in tobacco control, with concerns around long term health effects, marketing to youth, and how this diversification may help the industry to build credibility and influence policy makers.12

It is important to note that, despite increasing investment in these products, the core of the global tobacco industry’s business remains unchanged. Newer products form a small proportion of their revenue, compared to conventional products like cigarettes, and will do so for the foreseeable future.

Image 1: PMI’s newer products portfolio, as of 2024 (Source: PMI website)3

Background

Like its competitors, Philip Morris International (PMI) has been investing in newer nicotine and tobacco products that, unlike cigarettes, have potential for growth in developed markets.4 PMI’s current newer products portfolio consists of e-cigarettes, heated tobacco products and smokeless tobacco products (nicotine pouches and snus) (see Image 1).

In 2016, PMI began marketing its flagship new product IQOS (an HTP) under the catchphrase “this changes everything”, a phrase that was trademarked in 2017.56 In conjunction, PMI began making claims of corporate transformation and commitment to social change focussed on a “smoke-free” future:7

“Society expects us to act responsibly. And we are doing just that by designing a smoke-free future.”8

By October 2019, PMI had replaced the word “designing” with “delivering” (a smoke-free future), signposting the central role of the company in the realisation of this future.910

Despite the promising language in 2016-17, the majority of the company’s earnings still come from conventional cigarettes.1112 At its 2019 Annual General Meeting, PMI CEO André Calantzopoulos further confirmed to shareholders that “Our combustible tobacco portfolio remains the foundation of our business”.13 During the Covid-19 pandemic, PMI stated that in 2020 its “combustible tobacco portfolio showed resilience”12 and Marlboro cigarettes remain key to PMI’s business model.14

In May 2017, Vaping Post quoted Calantzopoulos (from an interview with Nikkei Asian Review), saying that in five years’ time (i.e. by 2022) “PMI could start talking to governments about phasing out combustible cigarettes entirely”.15 However, in 2020 PMI’s business is still predominantly focused on the sale of conventional tobacco products. There is evidence of new cigarette brand variants being launched in lower income countries, and conventional tobacco products continue to be vigorously promoted.16171819

Snus & Nicotine Pouches

From 2002, a time of increased tobacco regulation and declining cigarettes sales in Europe, the international tobacco companies started investing in a Swedish smokeless tobacco called snus.20 The product is sold as a paste or in a tiny pouch, and placed between the gum and lip for a period of time.

PMI was the last of the big international tobacco companies to invest in snus, albeit with little apparent enthusiasm. In October 2006, PMI acquired snus manufacturer Rocker Productions, and briefly sold 1847 by Phillip Morris on the Swedish market.21 Three years later, it sold Rocker Productions to Swedish Match as part of a deal that saw PMI and Swedish Match set up joint venture SMPM International to “globalise snus”.22 The joint venture never achieved commercial success, and in 2015 the two companies “mutually agreed” to dissolve the company.23

Although the other transnational tobacco companies had invested in snus-style products, including nicotine pouches, it was not until late 2019 that PMI expressed an interest. When questioned about the company’s plans at an investment conference, Calantzopoulos conceded that this was “an emerging category….which we are looking at as well”.24

In May 2021, PMI acquired Danish snus manufacturer AG Snus, which produces tobacco leaf products and nicotine pouches.2526 This acquisition was not widely publicised. However, in 2022 PMI reported it had launched “a reformulated version” of the Shiro branded nicotine pouches it acquired from AG Snus.27

More significantly, in the same year PMI acquired Swedish Match, manufacturers of snus and nicotine pouches, with a large market share in Northern Europe and the US.2829 This acquisition included Swedish Match’s nicotine pouch brand, Zyn, which in 2023 replaced PMI’s Shiro brand.303132

- For details see Philip Morris International and Swedish Match

See below for information on PMI’s acquisition of Fertin Pharma, which produces other oral nicotine products.

- For more information about the tobacco industry’s investment in snus and nicotine pouches, including PMI’s competitors, go to Cigarette Companies Investing in Snus.

Heated Tobacco Products

The year before the snus joint venture came to an end, PMI entered the HTP and e-cigarette markets (see below). At the time, CEO Calantzopoulos told the Wall Street Journal that he believed the future was in HTPs.33

PMI’s flagship HTP product, called IQOS, uses a battery-operated device that heats tobacco sticks originally called HEETS, which are available under several brand names (including TEREA) and in several flavours. They are also sold under cigarette brands Marlboro and Parliament in some countries.12

PMI periodically launches new and updated versions of its products which it tests in various markets. In 2019 it launched the IQOS Multi and IQOS Duo, followed by the IQOS ILUMA in 2021 and Bonds by IQOS in 2022. PMI were developing a second HTP brand, TEEPS, but following consumer testing PMI discontinued the TEEPS technology.

- For details see Heated Tobacco Products: Philip Morris International

In September 2023, PMI announced that it had developed a “non-tobacco” stick for IQOS devices called LEVIA.3435 See below for details.

E-cigarettes

As with snus, PMI was the last of the international tobacco companies to move into the e-cigarette market. In November 2013, PMI announced that it was going to produce its own e-cigarette.36 By 2019 the company had three e-cigarette brands in its product portfolio, two of which were sold only in the United Kingdom (UK) and Ireland, and the other only in Spain and Israel.

PMI has developed its own e-cigarette, IQOS VEEV (formally IQOS MESH), the only PMI e-cigarette labelled under the IQOS brand. CEO Calantzopoulos informed investors in December 2019 that Mesh was ready for further commercialisation, but that a global roll-out had been postponed due to the backlash against e-cigarettes following the sudden deaths of a number of vapers in the US.24 In January 2020, the roll-out appeared to be going ahead, with Calantzopoulos announcing “a launch in the coming months”.37 However it was delayed further by the Covid-19 pandemic and finally launched under the VEEV brand name in September 2020.381239

- For details see E-cigarettes: Philip Morris International

Market Expansion and Consolidation

At the beginning of 2020 PMI stated that its “Reduced Risk Products” (RRPs) account for nearly 20% of its net revenue, although it does not disclose publicly the profits from IQOS or other newer products.40 In early 2022, it stated that this figure was nearly 30%.27 It continues to expand the sales of its products through independent retailers and IQOS stores. In January 2020, the company reported that it had opened 26 new IQOS stores in South Africa since launching there in 2017.41

Collaboration with KT&G on HTPs and Hybrids

In January 2020, PMI announced a new “collaboration” with South Korean tobacco company KT&G (which dominates the South Korean market), to commercialize KT&G’s range of “smoke-free” products globally, alongside IQOS.37 The deal covered KT&G’s e-cigarettes and HTPs . Although KT&G has a US subsidiary, PMI stated at the time, that there were “no current plans to commercialize KT&G products in the U.S.”3742

In August 2020, KT&G’s lil SOLID HTP devices and Fiit heated tobacco sticks were launched in Russia, followed by Ukraine three weeks later.3843 It appears that lil SOLID is a rebranded Lil Plus device.44

When announcing its financial results in October 2020, PMI made clear the importance of having KT&G’s products in its product portfolio:

“This means that in both these markets [Russia and Ukraine] we now have HTU brands at three price points within the heat-notburn category: super-premium HEETS Creations/Dimensions, premium HEETS and mid-priced Fiit, all of which present attractive margins.”38

PMI launched KT&G’s lil HYBRID device in Japan in October 2020.45 This device uses as form of tobacco leaf and an e-liquid. While the tobacco contains nicotine, PMI referred to these as “Miix consumables and nicotine-free liquid cartridge”.38 This is likely to be because e-cigarette liquids containing nicotine are banned in Japan. KT&G stated that its lil Hybrid was a “distinctive platform”. However Japan Tobacco International (JTI) markets a range of hybrid HTPs (for details see Newer Nicotine and Tobacco Products: Japan Tobacco International). It appears that PMI aims to gain further market share in JTI’s home market, which is already dominated by IQOS.

By the end of 2022, PMI reported lil products were available in over 30 markets.46 In January 2023, PMI extended its collaboration with KT&G until January 2038.46

Collaboration with Kaival Brands on Single Use E-cigarettes

In June 2022, Kaival Brands International (KBI), exclusive distributor of Bidi Vapor products based in the US,47 entered into a distribution agreement with PMI to market its e-cigarette products outside the US.48 Central to this agreement is KBI’s single use e-cigarette, VEEBA, now part of PMI’s “smoke-free” portfolio.47 VEEBA was launched in Canada in 2022.47 BAT and Imperial Brands launched similar ‘disposable’ products in 2022, see E-cigarettes.

Undermining Tobacco Control Legislation

Although PMI has been promoting a “smoke-free” narrative, including funding the Foundation for a Smoke-Free World and its “Unsmoke” marketing campaign, it has also been working to undermine smoking bans and enable the use of IQOS in smoke-free areas.49 Just two months after the public smoking ban was introduced in the Czechia (then the Czech Republic) in 2017, PMI promoted IQOS on Radio Praha to Czech smokers. According to the radio station it: “might allow them [smokers] to ‘smoke’ in public places once again”.50

PMI has also been courting the hospitality industry to relax smoking bans by allowing the use of IQOS where smoking is banned.49 Allegedly more than 1,000 hotels around the world were offering “IQOS friendly rooms” in 2018, and “…in some cases, allow the use of smoke-free products in common areas”.51 The UK IQOS website published a list of the “15 Best IQOS Friendly Locations in London”, venues that are “happy to accommodate users of heated tobacco technology”.52 PMI has also promoted “smoke-free islands” in Greece and the Canary Islands.

In January 2020, Calantzopoulos argued that advertising regulations should be relaxed, saying that in the UK it was “difficult to talk to a consumer about a tobacco product” if the product could not be easily seen, which would make it “very difficult to switch”.53 However, although PMI has opened multiple IQOS stores in London, Bristol, Cardiff and Manchester, as an investigation by the Bureau of Investigative Journalist pointed out, as of February 2020 there were none in the UK towns and cities with the highest smoking rates.49

In February 2020, an investigation by The Guardian newspaper revealed that, in the UK, PMI lobbied for lighter regulation of IQOS, as a “considerably less harmful novel smokeless tobacco product” (CLHTP). PMI also proposed setting up a UK£1 billion fund for cessation services in exchange for the relaxation of advertising regulations for e-cigarettes and HTPs.54 It also tried to get IQOS adopted as a cessation product in New Zealand.555657

- For more information on PMI’s attempts to move into the cessation space see PMI’s IQOS: Use, “Quitting” and “Switching”

PMI has also taken advantage of tobacco control measures being implemented in the UK in order to promote its HTPs. In January 2019, PMI promoted IQOS and new, stronger variants of menthol HEETS sticks in the UK, ahead of the deferred EU Tobacco Products Directive ban on menthol cigarettes (due to come into effect in May 2020).58596061 An “IQOS Menthol starter kit” aimed at convenience stores was available to retailers via a website called “menthol-ban-retail.co.uk”.5862 Run by Philip Morris Ltd (PML), the website stated that “From 20th May 2020, the only menthol tobacco you can sell is HEETS” (noting that specialist cigars and cigarillos were exempted from the ban). It also contained a claim that “51% of menthol smokers would replace menthol cigarettes with IQOS after the ban”.62

PMI has used threats of litigation to attempt to delay proposed tobacco control measures that cover its HTPs. In 2023, PMI sent a letter to the UK Department of Health and Social Care threatening legal action following the announcement and consultation on a newly proposed smokefree generation bill. The company cited particular concern over the inclusion of HTPs in the bill, stating it does “not believe that reduced-risk smoke-free products—including heated tobacco—should be included alongside combustible cigarettes in any potential legislation”.63

- For more information on PMI’s interference in this and other endgame policies, see Tobacco Industry Interference with Endgame Policies

PMI has lobbied to overturn HTP and e-cigarette bans and create a market for its products in Australia.646566 For more details see Heated Tobacco Products.

PMI has also conflated its e-cigarette and HTPs, both now branded as IQOS, which has implications for product regulation and public information.67 For details see IQOS: Use, “switching” and “quitting”.

Nicotine products designed to circumvent regulation

In September 2023, PMI announced in a presentation to investors, that it had developed a product for IQOS devices called LEVIA containing “non-tobacco substrate infused with nicotine and tobacco, menthol and fruit flavourings.3435 It did not specify what the substrate contained.

It appeared that this product was developed in order to circumvent regulations which apply to heat sticks containing tobacco, specifically potential bans on flavours. PMI stated that “in some jurisdictions this may not be subject to, for example, flavor regulations” and that it would likely not be regulated before the product arrived on the market.3435

PMI piloted LEVIA in Indonesia (where it stated there was a “lack of readiness” for HTPs) before a planned launch in the US.68 PMI’s presentation to investors indicated that other markets of interest might be India and Pakistan.68

The company stated that this product would was “designed for the early adopters within the IQOS franchise and for legal age nicotine users that are flavor explorers” and cause “minimal social disturbance”.34

Acquired Pharmaceutical Companies and NRT-Type Products

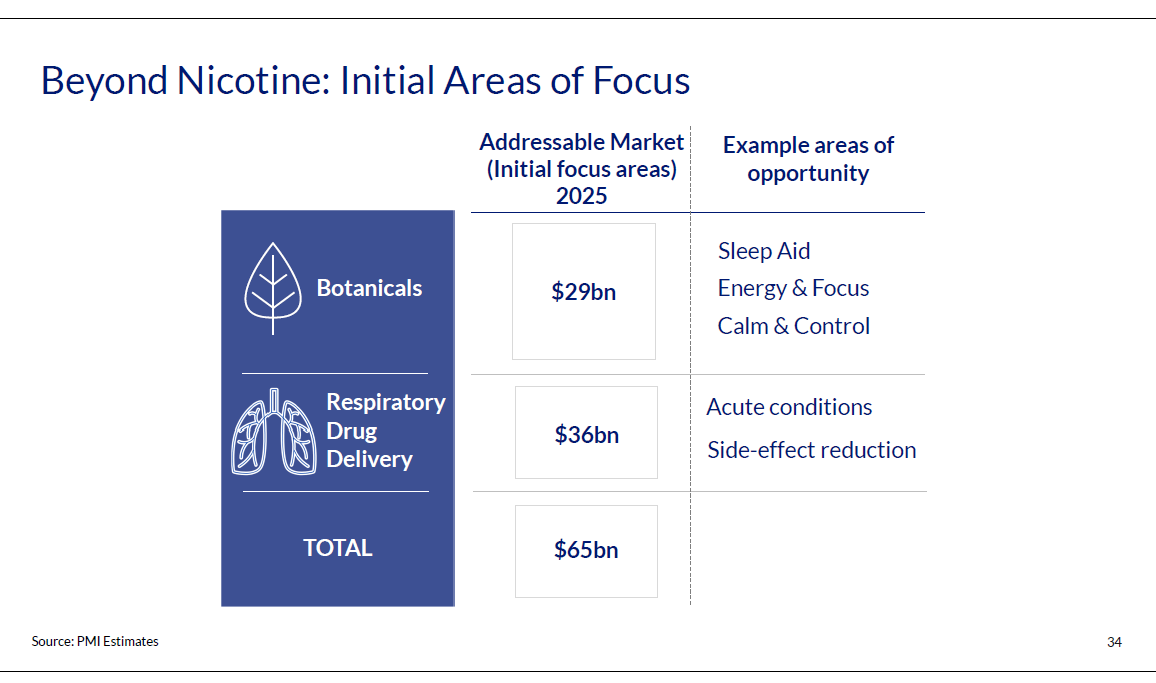

In a presentation to investors in February 2021, PMI stated that it planned to go “beyond nicotine” into “botanicals” and “respiratory drug delivery” (image 3).69 It said that this was part of its “long term evolution into a broader lifestyle & consumer wellness company”.69

Image 3: Slide from PMI presentation to investors, 10 February 2021. (Source PMI website)

It is not clear if this strategy includes cannabis products (see below).

Syqe Medical

In 2016, PMI bought an Israeli company, Syqe Medical, which was developing a cannabis inhaler.70

Fertin Pharma

In July 2021, PMI acquired Fertin Pharma, a manufacturer of “innovative pharmaceutical and well-being products based on oral and intra-oral delivery systems” and “Nicotine Replacement Therapy (NRT) solutions”.71 PMI referred to these products as “modern oral” and includes nicotine pouches in the same category.71 (The term “modern oral” appears to have been first used by British American Tobacco). PMI’s acquisition was completed in September 2021.

Vectura

Also in July 2021, PMI announced its intention to acquire Vectura, a UK company specialising in inhaler products to deliver medicines.7273 PMI gained control of the company in September 2021.

Vectura Fertin Pharma was established by PMI in 2022 to oversee the commercial development of its pharmaceutical acquisitions.74

OtiTopic

In August 2021, PMI also announced its acquisition of OtiTopic, a US-based respiratory drug development company which was developing an inhalable treatment for heart attacks, called ASPRIHALE.75

- For further details of the above companies see Tobacco Company Investments in Pharmaceutical & NRT Products

TobaccoTactics Resources

- Philip Morris International

- E-cigarettes: Philip Morris International

- Heated Tobacco Products: Philip Morris International

- PMI’s IQOS: Use, “Quitting” and “Switching”

- Heated Tobacco Products

- Cigarette Companies Investing in Snus

- Newer Nicotine and Tobacco Products

- Industry Approaches to Science on Newer Products

Relevant links

- PMI website

- Foundation for a Smoke-Free World website

- STOP report: Addiction At Any Cost: The Truth About Philip Morris International

TCRG Research

Identifying misleading corporate narratives: The application of linguistic and qualitative methods to commercial determinants of health research, I. Fitzpatrick , A. Bertscher, A.B. Gilmore, PLOS Global Public Health, 16 November 2022, doi:10.1371/journal.pgph.0000379

Tobacco industry messaging around harm: Narrative framing in PMI and BAT press releases and annual reports 2011 to 2021, I. Fitzpatrick, S. Dance, K. Silver, M. Violini, T.R. Hird, Frontiers in Public Health, 18 October 2022, doi:10.3389/fpubh.2022.958354

Transnational tobacco company interests in smokeless tobacco in Europe: Analysis of internal industry documents and contemporary industry materials, S. Peeters, A. Gilmore, PLoS Medicine, 2013,10(9):1001506, doi:10.1136/tobaccocontrol-2013-051502

Understanding the emergence of the tobacco industry’s use of the term tobacco harm reduction in order to inform public health policy, S. Peeters, A.B. Gilmore, Tobacco Control, 2015; 24:182-189

For a comprehensive list of all TCRG publications, including research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.